Running a small business in 2025 means having seamless, secure, and cost-effective payment processing solutions. Whether you operate an online store, a brick-and-mortar shop, or a hybrid business, choosing the right payment processor can significantly impact cash flow, customer satisfaction, and overall efficiency.

With so many options available, selecting the best payment processor can be overwhelming.The overwhelming array of payment processors makes finding your ideal match a significant challenge for any business. That’s why we’ve done the heavy lifting for you – analyzing transaction costs, security features, platform integrations, and support quality to bring you this curated list of 2025’s top 10 payment solutions for small businesses.

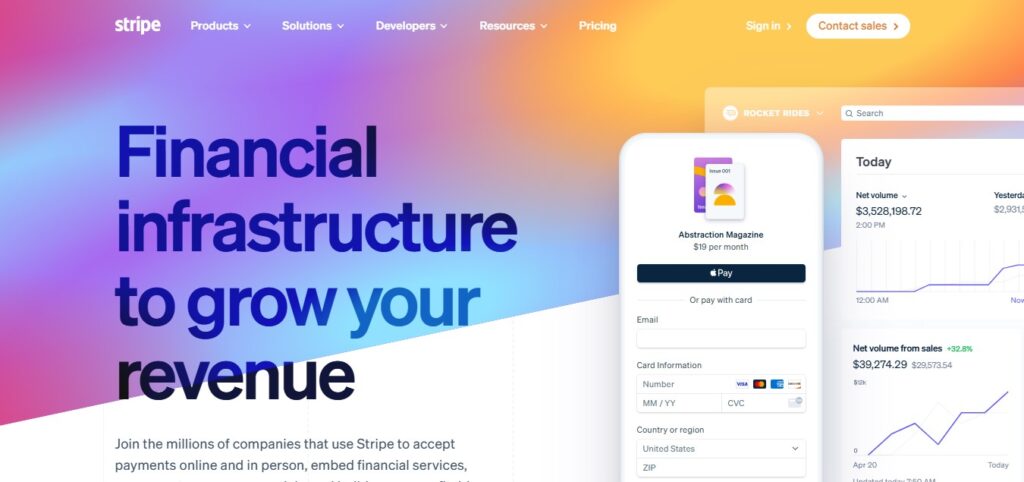

1. Stripe

Best for Online Businesses & Developers

Stripe remains a top choice for eCommerce businesses and developers due to its powerful API, customization options, and global reach. It supports credit/debit cards, digital wallets (Apple Pay, Google Pay), and even cryptocurrency payments.

Key Features:

- Flat-rate processing at 2.9% plus $0.30 for each online payment

- Subscription & recurring billing tools

- Strong fraud prevention with Stripe Radar

- Supports 135+ currencies

Stripe is ideal for businesses that need a scalable, developer-friendly payment solution.

2. Square

Ideal for Face-to-Face Transactions and On-the-Go Sales

Square is a favorite among small retailers, food trucks, and service-based businesses. Its free card reader and easy-to-use POS system make it perfect for businesses that accept payments on the go.

Key Features:

- No monthly fees (Pay-as-you-go: 2.6% + $0.10 per tap/dip/swipe)

- Free invoicing & virtual terminal

- Integrated payroll & inventory management

- Offline payment mode

Square’s simplicity and affordability make it a strong contender for small businesses.

3. PayPal

Best for Freelancers & Global Transactions

PayPal is one of the most recognized payment processors, trusted by freelancers, online sellers, and international businesses. Its Buy Now, Pay Later (BNPL) option helps increase conversions.

Key Features:

- 3.49% + $0.49 per online transaction

- One-click checkout with PayPal Express

- Strong buyer & seller protection

- Supports 25+ currencies

PayPal is excellent for businesses that need quick setup and global payment acceptance.

4. Shopify Payments

Best for eCommerce Stores on Shopify

If you run a Shopify store, Shopify SPayments eliminates third-party transaction fees and integrates seamlessly with your online store.

Key Features:

- Competitive rates (2.4% – 2.9% + $0.30 per transaction)

- Zero extra charges when you process through Shopify Payments

- Built-in fraud analysis

- Multi-currency support

This is the best option for Shopify merchants who want an all-in-one solution.

Conduct Industry Analysis in Seconds – For Free!

Discover how QuantexFlow can help you quickly analyze any industry with powerful AI-driven insights. Perfect for entrepreneurs, investors, and business analysts.

Try It Now – FreeNo credit card required. Get instant access to industry insights.

5. Helcim

Best for Transparent Pricing & Low Fees

Helcim stands out for its interchange-plus pricing, which offers lower fees compared to flat-rate processors. It’s great for businesses processing high volumes.

Key Features:

- Interchange-plus pricing (0.30% + 8¢ above interchange)

- No monthly fees for low-volume businesses

- Free virtual terminal & invoicing

- Excellent customer support

Helcim is ideal for cost-conscious businesses that want fair, transparent pricing.

6. Clover

The Ultimate All-in-One Solution for Restaurants and Retailers

Clover delivers a complete business management platform combining POS, payments, inventory control, and staff management – making it ideal for full-service dining establishments and boutique retailers alike.

Key Features:

- Customizable POS hardware

- Loyalty program integrations

- Table-side ordering for restaurants

- 2.3% + $0.10 per transaction

Clover is best for businesses that need a complete POS and payment solution.

7. Stax (Formerly Fattmerchant)

Best for Subscription-Based Businesses

Stax offers membership-based pricing, making it cost-effective for businesses with high monthly sales.

Key Features:

- Flat monthly fee + interchange rates

- Advanced analytics & reporting

- API for custom integrations

- No markup on transactions

Stax is perfect for SaaS companies, membership sites, and high-volume merchants.

8. QuickBooks Payments

Best for QuickBooks Users

If you already use QuickBooks for accounting, QuickBooks Payments seamlessly syncs transactions, reducing manual data entry.

Key Features:

- 2.4% + $0.25 per transaction (invoiced payments)

- Automatic reconciliation with QuickBooks

- ACH payments at 1% (max $10)

- Mobile payment acceptance

This is the best choice for small businesses using QuickBooks.

9. Adyen

Best for Enterprise & Global Businesses

Adyen is a global payment processor used by companies like Uber and eBay. It supports 250+ payment methods worldwide.

Key Features:

- Unified commerce (online, in-store, mobile)

- Dynamic currency conversion

- Advanced fraud detection

- Custom pricing for high-volume merchants

Adyen excels for growing enterprises serving global markets

10. Razorpay

Razorpay is a powerful, developer-friendly payment gateway designed to simplify transactions, reduce checkout friction, and boost conversions for online businesses. Whether you’re on Shopify, Wix, or a custom website, Razorpay integrates seamlessly to provide a smooth payment experience

Key Features:

- Multiple Payment Options – Accept credit/debit cards, UPI, NetBanking, wallets (Paytm, PhonePe), and even BNPL (Buy Now, Pay Later).

- One-Click Checkout – Razorpay Magic Checkout saves customer details for faster repeat purchases.

- Smart Analytics Dashboard – Track transactions, refunds, and settlements in real-time.

- Fraud Protection – Advanced security with PCI-DSS compliance and AI-powered risk detection.

- Subscription & EMI Support – Perfect for SaaS businesses or high-ticket stores.

- Easy Integration – Works with Shopify, WooCommerce, Magento, and custom-coded sites.

Razorpay vs. Competitors

| Feature | Razorpay | PayPal | Stripe | PayU |

|---|---|---|---|---|

| Indian Focus 🇮🇳 | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| UPI Payments | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| Magic Checkout | ✅ Yes | ❌ No | ✅ (Stripe Payments) | ❌ No |

| Zero Setup Fee | ✅ Yes | ❌ ($0.30 + 2.9%) | ✅ Yes | ❌ (Varies) |

Selecting the Right Payment Processor for Your Business Needs

When selecting a payment processor, consider the following:

- Transaction Fees – Flat-rate vs. interchange-plus pricing

- Payment Methods – Credit cards, ACH, digital wallets

- Contract Terms – Avoid long-term contracts if possible

- Integration – Does it work with your POS, eCommerce platform, or accounting software?

- Customer Support – 24/7 support can be crucial

Final Thoughts

The best payment processor depends on your business model, sales volume, and customer preferences. Stripe and PayPal are great for online businesses, Square and Clover excel in in-person sales, while Helcim and Payment Depot offer the best pricing for high-volume merchants.

By choosing the right payment processor, you can reduce costs, improve cash flow, and enhance customer experience key factors in growing your small business in 2025.

Which payment processor are you considering? Let us know in the comments!

Payment Processors Explained

Tap questions to compare your options

How quickly do processors pay out?

Standard: 2-3 business days

Fastest: Same-day (PayPal, Square)

New businesses: May have 7-day holds initially

What are typical fees?

2.9% + $0.30 (Stripe)

2.6% + $0.10 (Square)

1.5% + $0.20 (Helcim)

1.3% + $0.10 (Payment Depot)

Which is safest for high-risk industries?

- Durango – Specializes in high-risk

- PayKings – CBD and vape friendly

- PaymentCloud – Good approval rates

Best for international payments?

Payoneer (200+ countries)

Stripe (135 currencies)

Wise (0.4% markup)

Revolut (interbank rates)

Running a small business in 2025 seems like navigating a maze of payment processors! Stripe, Square, PayPal, Shopify Payments, and Helcim all sound impressive, but how does one truly decide which is best without testing them all? I’m intrigued by Stripe’s developer-friendly approach and Square’s simplicity, but I wonder—can a small business owner really afford to experiment with multiple platforms before finding the right fit? Helcim’s interchange-plus pricing sounds like a game-changer for cost-conscious businesses, but does it come with hidden complexities? And why isn’t there a one-size-fits-all solution yet? If someone has tried multiple platforms, I’d love to hear their experience—what worked, what didn’t, and why? How do you balance features with affordability without sacrificing security?

For cost-conscious, high-volume businesses, Helcim’s interchange-plus is a winner—transparent, scalable, and secure.

For startups or low-volume merchants, flat-rate models might simplify budgeting despite higher long-term costs.

Always audit statements: Even with interchange-plus, monitor markups and card mix to maximize savings.